Growth, increased arrivals, but an eye on cost in France

- Published:

- March 2024

- Analyst:

- Phocuswright Research

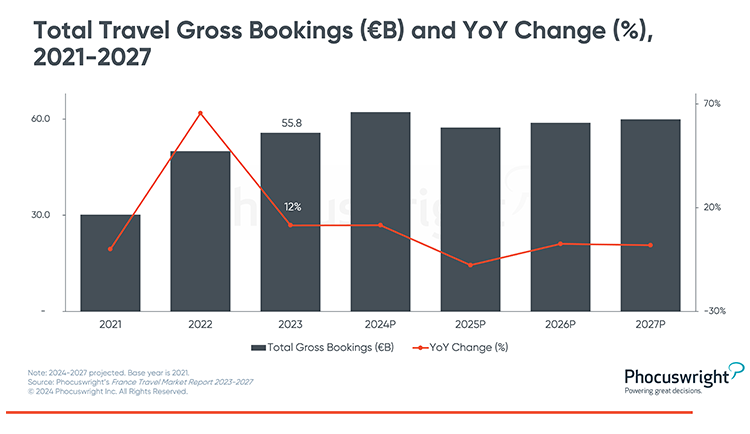

The French travel sector grew 12% to €55.8 billion in 2023 (see figure below), driven by the global recovery in international travel and buoyant domestic demand. According to Phocuswright’s latest research report France Travel Market Report 2023-2027, a stronger French economy and record low unemployment rates benefited the travel market, although gains were tempered by price inflation. Travel remains a priority for the majority of French consumers, and all segments of travel saw substantial growth in 2023.

Much of the travel market's growth can be attributed to the widespread return of international visitors. Flight searches for French destinations grew significantly in 2023, according to data from Sojern. Nearly 100 million international tourists visited France in 2023, up from 93 million in 2022. While tourism from North America recovered in the previous year, 2023 witnessed more diversity in source countries. Visitation from the APAC region increased, but travel from China, typically a lucrative inbound market, has been slower to rebound.

International traveler numbers were also amplified by the 2023 Rugby World Cup, as well as the return of major exhibitions such as the Paris Air Show. Arrivals are expected to grow further in 2024, with an extra 12 million visitors expected for the 2024 Olympics and Paralympics events. Capitalizing on the notoriety gained from these sporting events and bolstered by the French government's commitment to supporting and promoting the destination, France will remain a popular destination for international visitors in the medium term.

While domestic travel demand waned slightly in 2023, the French appetite for travel remains strong. French travelers are gradually returning to their traditional travel pattern of an annual two-to-three week summer vacation supplemented by several shorter domestic breaks throughout the year. However, high prices, and in particular the soaring cost of transportation, are moderating growth. The economic environment may lead some French travelers to limit their spending, decrease trip length and/or opt for lower priced accommodation, short-term rentals or camping.

At the same time, trip frequency is increasing. French consumers are opting to take multiple weekend breaks, and the winter skiing period in particular is benefiting. However, proposals to shorten and consolidate school holidays, which would amplify periods of peak demand, may have a detrimental effect in the medium term.

This report provides a comprehensive view of the France travel market, including detailed market sizing and projections, distribution trends, analysis of major travel segments, key developments and more. Other reports in the Europe Travel Market Report 2023-2027 series (available now or publishing soon):

- Europe Travel Market Report 2023-2027

- Germany Travel Market Report 2023-2027

- Italy Travel Market Report 2023-2027

- Scandinavia Travel Market Report 2023-2027

- Spain Travel Market Report 2023-2027

- U.K. Travel Market Report 2023-2027

- Europe Travel Market Data Sheet 2023-2027 (subscriber only)

Phocuswright works closely with companies in all sectors of the travel industry to provide the research and data needed to make smart business decisions.

The Phocuswright Open Access research subscription offers the world's most comprehensive library of global travel research and data visualization. You receive company-wide access to all of our syndicated material and interactive data, so your entire team can get the most up-to-date trends and information.

We also offer subsidized subscription packages for destination marketers, startups and universities.

Explore the Open Access benefits best suited to your company.

.png)

.jpg)