A different type of sustainability research

- Published:

- December 2023

- Analyst:

- Phocuswright Research

Sustainability may be a hot topic within travel, but acknowledgement and understanding of the issue by the industry does not necessarily translate to awareness or concern from travelers. According to Phocuswright’s travel research report Sustainability Dissonance: What Travelers Say vs. What They Do (and What to Do About It), travelers often have good intentions, but they lack an understanding of how to travel sustainably, and sustainability considerations rarely impact their trip decisions. Knowledge of travelers' awareness of the issues, motivations to travel sustainably, travel behaviors and how much responsibility they are willing to take for the health of the destinations they visit is crucial for the industry as it aims to involve travelers in making travel more sustainable.

Phocuswright fielded an online survey on June 2 - June 26, 2023, through a Dynata consumer panel, targeting travelers in the U.S., U.K., Germany, France, Italy and Spain. To qualify for participation in the study, respondents had to indicate having taken at least one overnight leisure or bleisure trip in the past 12 months.

To mitigate potential bias where respondents believe they do the right thing and overstate their intentions and actions, the first half of the survey was blinded: Respondents answered historical trip questions without knowing they were participating in a study about sustainability. In the second half of the survey, respondents answered questions after the study purpose was revealed. This allowed us to compare awareness, attitudes and intentions around sustainability with actual travel behavior.

At The Phocuswright Conference last month, senior analyst Madeline List gave a presentation of the key takeaways from this study. Here are the highlights:

Transportation:

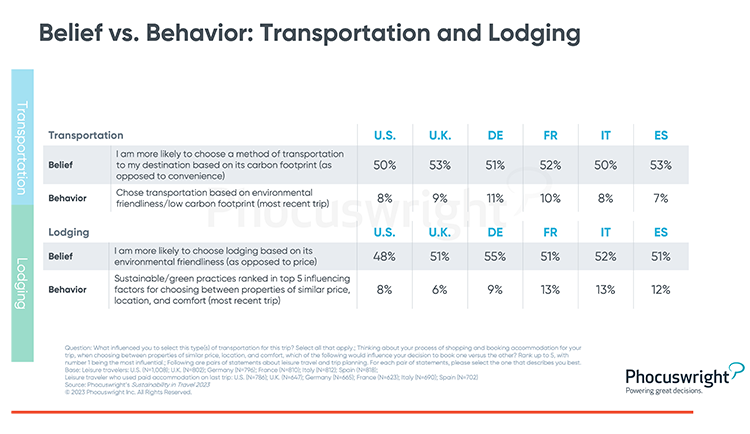

“Across all the markets Phocuswright looked at in the U.S. and Europe, about half of people said that they were more likely to choose a method of transportation for its carbon footprint than for convenience. That sounds amazing, we’re in great shape that way, right? Well, what happens when we look at how people actually chose their last method of transportation for their last leisure trip, based off of the behaviors travelers reported before they knew they were participating in a sustainability study? Then it’s more like 1 in 10 people, sometimes less, who actually chose their transportation based on environmental friendliness. And only 3-8% bought carbon offsets on their most recent trip.”

Lodging:

“What happens when we look at lodging? Again, around half of people say they’re more likely to choose an accommodation for environmental friendliness over price. But when we ask those travelers how they selected properties of similar price, location, and comfort on their last trip … Again, a huge drop off. It’s only 6-13% who said sustainability was a top factor for choosing lodging among competitive properties that were already similar.

If you’re wondering to yourself, well, you’re looking at too big of a swath of these populations. Not everybody cares about sustainability, and they’re corrupting the sample. What happens when you just look at the travelers who said that they care?

Don’t worry, we thought about that too – and the way it works is that if someone thinks about sustainability at home then they are more likely to choose green transport and lodging, but it’s still a minority. We’re talking less than one in 5 of people who care about sustainability as a cause are making greener choices in travel products. It’s even lower if someone isn’t sustainability oriented at home."

Destination selection:

“Things get interesting when we get to destination selection. Crowding: that’s a pain point, it bothers people. So what do travelers do when a sustainability issue affects their trip? Again, around half say that they would rather visit a place that’s not well known if it’s also less crowded.

And here we get a little more follow through – up to 28% stayed in a lesser known area to avoid crowds on the most recent trip. So we start to close the gap a bit when a sustainability issue directly impacts the consumer experience. But still a significant discrepancy between how many people say they prefer the quieter areas and how many follow through.”

Interested in more in-depth research on this topic? Phocuswright’s Sustainability Dissonance: What Travelers Say vs. What They Do (and What to Do About It) is part of a comprehensive consumer research study focused on sustainability in the modern travel environment. Specific topics covered include:

Sustainability awareness on the part of the traveler.

Defining the belief/behavior disconnect, and discussion of other consumer disconnects.

Addressing consumer education on sustainability, and highlighting where the market can fill in gaps or meet consumer needs.

Outlining a range of practical recommendations and initiatives that travel businesses can deploy to better engage consumers and remain competitive.

Watch the full presentation from The Phocuswright Conference: https://www.youtube.com/watch?v=g154VoOW124

For further intelligence for you and your entire company, subscribe to Phocuswright Open Access. This subscription puts the entire Phocuswright research library and powerful data visualization tools at your fingertips. There’s a reason executives around the world trust and reference Phocuswright research and data on a daily basis. Explore for yourself why.

Plus, we just redesigned Phocal Point, the powerful data visualization tool that now makes it easier to access and interpret Phocuswright data.

It's all about the data. With an updated navigation interface, new dynamic filtering, additional segment and channel breakouts in select markets and rich detailed views of 35+ markets, Phocal Point allows you to create custom interactive charts and view travel data by segment, channel, device, region and country. Our proprietary travel industry market sizing data allows you to look to the future with projections through 2026, and review historical data as far back as 2009.

.png)

.jpg)