A Phocuswright Special Project

Scroll, Heart, Fly: Social Media’s Impact on Travel

Dig deeper into what type of social content is really influencing travelers minds.

Lead the way in providing influential social content and marketing: Sponsor pivotal research to elevate your industry standing

Social is deeply embedded in the travel journey

Social media platforms are in the fabric of how travelers plan, research, and share their trips. From investigating the first sparks of a trip idea until the time they reach home and share memories, social is a piece of the modern trip experience.

For travel brands and destinations, social media can be a double-edged sword. On one hand, it’s a visually powerful, far reaching and cost-effective way to communicate with consumers. On the other, viral content can drive overtourism in hot spots or encourage bad behavior “for the gram”.

With a body of content growing every day from acquaintances, brands, and influencers posting to platforms, it’s time to untangle the expansive use of social in travel and understand how to best leverage it for the modern traveler.

Social conversion for travel is unique

Many of the current market insights on social commerce come from retail, a space where impulsive and low-stakes purchases are common. Travel follows its own rules – and its own conversion periods for components.

The average American worker has only 11 days of paid time off a year, so leisure travel decisions are anything but casual. Before travelers ever hit the “book” button, they actively and passively collect information on what appeals to them, what’s worth the money, and how their time will be best spent.

Research is needed to understand both how social content affects travelers at different points in research and booking – and where they’re most receptive to influence.

⬇️ Scroll to see Research Objectives, Key Questions to be Addressed and the benefits of sponsoring like getting the data.

This clip from The Phocuswright Conference 2023 features senior analyst Madeline List discussing content that can be most impactful on social platforms.

Featuring panelists:

Sanjay Bhatia, Travel Industry Director, Meta

Kelly Covato, US Head of Travel, Snap

Gary Morrison, CEO, Hostelworld

Watch the full interview here.

Phocuswright will work with you to align credible intelligence with your leadership position in social, while giving you access to proprietary research that assists with strategy, product and marketing positioning.

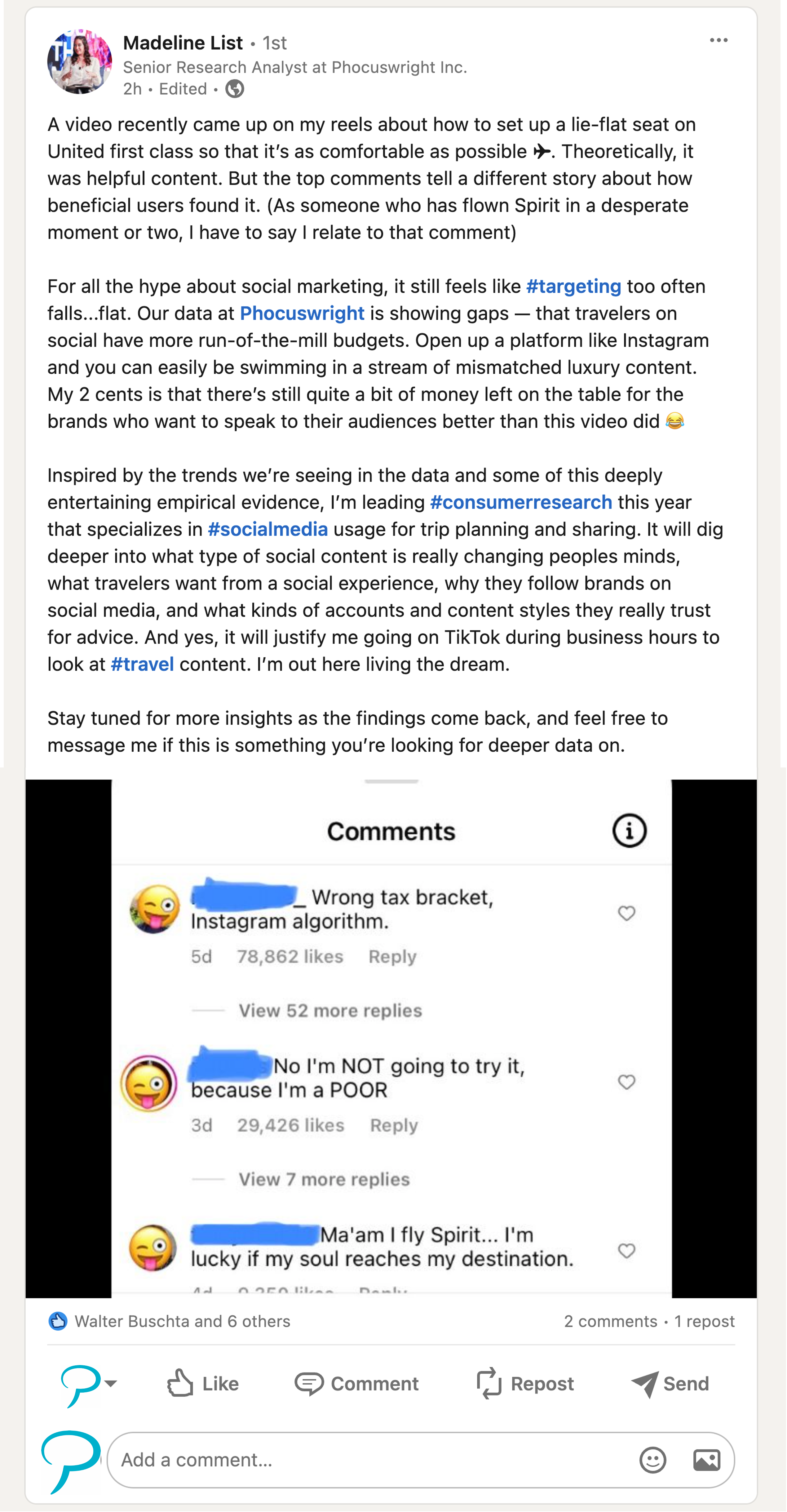

Inspired by the trends in the data, senior analyst Madeline List will lead this consumer research study that specializes in social media usage for trip planning and sharing.

It will dig deeper into what type of social content is really changing peoples minds, what travelers want from a social experience, why they follow brands on social media, and what kinds of accounts and content styles they really trust for advice.

Email us at sales@phocuswright.com

Research Objectives

Understand how travelers use social content to make trip decisions, including:

- How social is used at different points in the travel journey

- Differences by segments

- Platform usage

- Account preferences (personal acquaintances, brands, destinations, influencers)

- Content preferences

Findings can be used to develop actionable insights on:

- Forming best practices on leveraging social content

- Optimizing social targeting Improving engagement and trust

- Tailoring content style and tone to consumer tastes

Key Questions to be Addressed

- At what points in the travel journey do travelers use social content? How do their needs differ throughout the course of trip planning and traveling?

- Who do travelers choose to follow and take travel advice from?

- What type of content do travelers find most useful, trustworthy and engaging?

- How does content engagement differ by demographics?

- How do travelers view paid ads or influencer collaborations?

- When do travelers actively seek out information versus wait for information to be pushed at them?

- How do travelers choose what and how they share on social?

- Which untapped traveler segments on social, if any, could offer opportunities for brands?

- How is social commerce likely to evolve?

Click here for full sponsor benefits. Or contact us at sales@phocuswright.com

Social feeds are full of beautiful luxury travel content, but does it miss the mark if the audiences can't afford it?

Thought leaders and big social brands think there are far more opportunities for mid-tier and budget travel companies to capitalize on social marketing.

This upcoming research will explore how well travelers are really being targeted on social, and give travel industry leaders data to better understand and speak to their needs.

Phocuswright research found 35% of travelers ages 18 to 34 use TikTok to help decide what activities to partake in while traveling.

And while Phocuswright’s U.S. Consumer Travel Report 2023 found user generated content [UGC] posted by family and friends are travelers’ most-cited source for inspiration, influencer-created content has a different kind of value.

“That user-generated content is incredibly important for brands to leverage, but its weakness is that it has limited reach – acquaintances only travel, use or mention specific travel brands so often,” Madeline List, senior reporter, Phocuswright, said. “More sophisticated social media strategies balance both UGC with brand content or even influencer collaborations to maximize both trust and reach.” - Madeline List

Read the full PhocusWire Story: GetYourGuide is Hiring a TikTok Content Creator: Here's Why

More Phocuswright research on social:

Learn more about Phocuswright Special Projects:

Sponsorship levels & deliverables »

Add-on options »

Project timeline »

Design Your Own Sponsorship Package

Let us create the sponsorship package that's right for your company.

Contact our team today: +1 860 350-4084 x501

Email us: sales@phocuswright.com

What about the impact social has on a destination?

The extremely wide reach of social networks also sparks fear that places will go viral too quickly for a destination to manage the resulting swarms of users intent on visiting trendy areas. Though these cases are likely to be fueled by a minority of travelers, that's expected to grow over time as social media gains even more traction. According to Phocuswright's travel research report Far From the Madding Crowd? The Truth About Overtourism and Dispersal, just 22-30% of travelers said that they make a specific effort to go to the places featured from their personal networks, discovery feeds or from influencers (see figure to left).

However, travelers ages 18-34 are most likely to say that trait describes them well. So the trend is likely to increase as this digitally comfortable population becomes a larger part of the overall traveler population. Destination managers need to account for a long-run trend of social media affecting traveler decisions.

Some travelers choose tours and activities based on the opportunity to get good photos, which may cause traffic jams or tourist bottlenecks when done in inopportune places. While many of these photos may land on social media and can appear to have been taken for status or the recognition of having visited a special place, travelers are not motivated by social media presence alone. In most markets, travelers ages 55+, who use social media infrequently, show similar likelihood to their younger counterparts for choosing in-destination activities for the sake of taking photos. The desire to capture a moment - and all the attendant issues that causes - need to be addressed, apart from simply discouraging people to produce less social media content.

While travelers may not be going to places just because they're famous, the fame card can determine what lands in their consideration set. Travelers aren't necessarily aware of alternative destinations, especially if information on them is hard to find. From that perspective, encouraging dispersal is not necessarily a challenge of overcoming a quest for status or visiting famous places, but a battle of pushing awareness and reducing barriers to finding equal-value alternatives that satisfy both sustainability and travel needs. For dispersal across tours, activities or attractions, there's an opportunity to show how alternative tours, activities or sites could cater to traveler interest and satisfy their trip goals, instead of following a generic checklist of things to see and do.

Get the full report:

WEEKLY RESEARCH INSIGHTS

We dig deep to give you the data and trends that drive the travel, tourism and hospitality industry.

Get the latest in travel industry highlights with our free weekly research articles and more. Sign up to get the latest delivered directly to your inbox.

FOR MORE INSIGHTS

See all of Phocuswright's free research insights here.

Sign up to get the latest delivered directly to your inbox.

Open Access Research Subscription

Research is our priority. Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips.

Clients have relied on Phocuswright's deep industry knowledge for over 25 years to power great decisions, help justify a pitch, build a strategic plan and elevate any presentation through trusted research and data. When companies and executives reference Phocuswright, they gain the trust of an industry keen on data, trends and analytics.

See the full benefits of an Open Access subscription here.

Contact Us

For any questions you may have, please call or email us at

📱 +1 860 350-4084

📧 info@phocuswright.com

About Phocuswright

Events

FAQ

Copyright

Contact Us

Research

News

Privacy & Terms

Press Room

Email Updates

Register for Phocuswright emails about research data, events and more:

A WHOLLY OWNED SUBSIDIARY OF

Copyright © 2023 by Northstar Travel Media LLC. All Rights Reserved. PO Box 760, Sherman, CT 06784 USA | Telephone: +1 201 902-2000

The Phocuswright Conference • Phocuswright Europe • Global Startup Pitch • Travel Tech Fellowship • Phocuswire • Web In Travel • Inntopia • Retail Travel • Hotel Investment