China Online Travel Overview: Leapfrogging to the Mobile Lead

- Published:

- August 2015

- Analyst:

- Maggie Rauch

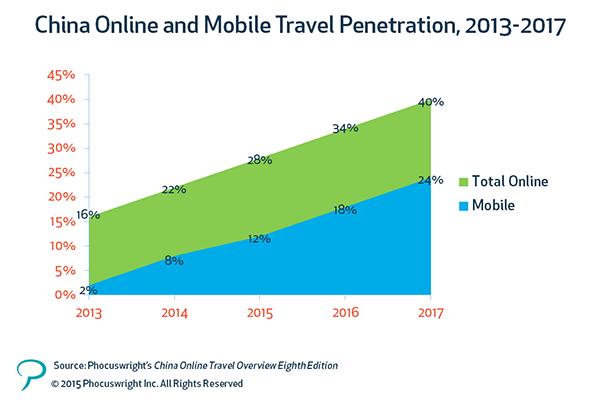

A lightning-fast shift to mobile is transforming travel in China. The world's second-biggest travel market, China now holds the globe's highest mobile travel penetration rate. And by 2016, mobile bookings will leapfrog past desktop bookings to make China the world's first majority-mobile online travel market.

Travel providers took in more than US$10 billion in bookings through mobile in 2014, more than one third of the country's online travel bookings, according to Phocuswright's China Online Travel Overview Eighth Edition (an Asia Pacific and Global Edition publication). Everything happening in the country's travel industry – from Expedia's divesture of its local presence to the boom in startup funding – is now driven by innovation and execution through mobile channels.

(Click the chart to view a larger version.)

As travel research and shopping behavior changes at an unprecedented rate, competition for consumer attention is fierce among established online providers, upstarts and big Internet companies. Ctrip and Qunar are the clear leaders online, and elbowed out one of their biggest competitors in early 2015 when Ctrip took over the biggest stake in onetime Expedia property eLong. At the same time, online e-commerce giants Alibaba and JD.com pushed deeper into travel with strategic acquisitions and rebrands. And startup activity represents yet another competitive set, one which is increasingly armed with the capital. Chinese online travel startups received a whopping $1.7 billion in 2014 – two and half times as much funding as the previous year.

Mobile and online penetration is surging across all travel segments in China. The most-penetrated segments – air and lodging – continued to move online, with 40% growth for online air and 55% growth for online lodging in 2014. The biggest transformation is occurring within rail, which represented 6% of the market's online travel gross bookings in 2014, and will leap to nearly a quarter by 2017.

While China's online and mobile travel segments are surging upward, the country's broader travel market is experiencing growing pains. By all accounts, the overall Chinese economy is cooling off, and the government's strict limits on lodging and flights for state-owned enterprises continue to adversely affect travel. However, China's total travel market is projected to gain a total of 35% between 2014 and 2017.

Phocuswright's China Online Travel Overview Eighth Edition provides a comprehensive outlook of China's competitive online travel market, the factors influencing who wins and loses, and how best to come out ahead in this growing marketplace.

Topics include:

- Size of China's total and online leisure and unmanaged business travel markets

- Market forecasts through 2017

- In-depth breakdown of all major travel supplier segments, including airlines, rail, hotels, car rental and packaged travel

- An examination of online travel trends and forecasting

- Supplier and OTA booking analysis and forecasts

- A look at intermediaries, the "Wild East"

- Exploration of ground transport (car rental, ride sharing, and taxi hailing)

This report delivers a clear view of where China's online travel market stands today – and where it's going. With analyses of the current landscape, future trends and forecasts, Phocuswright's China Online Travel Overview Eighth Edition offers a definitive understanding of the opportunities and challenges in China's online travel market.

.png)

.jpg)