Report

Private Accommodation Muscles in on Hotels in the U.S. and Europe

From Buzzword to Bottom Line: Keeping Pace With Gen AI in Travel

In 2023, generative AI (GenAI) took center stage in the travel industry, driving efforts to optimize...

Read More

U.S. Cruise Market Report 2023-2027

The U.S. cruise industry has soared to new heights in 2023, with gross bookings rising an impressive...

Read More

Phocal Point: Country and Regional Sizing

Tap into the most recent data on the 38+ covered travel markets. Data is presented in a visually...

Read More

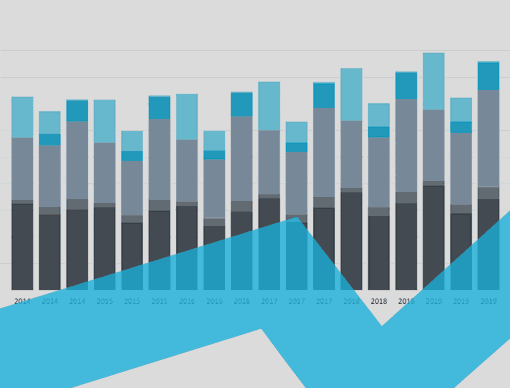

Private Accommodation Muscles in on Hotels in the U.S. and Europe

- Published:

- April 2017

- Research Type:

- Report

- Format:

- HTML & PDF

- Pages:

- 17

- Figures:

- 13

- Segment:

- Hotels & Lodging

- Region:

- Europe, U.S. & Canada

FREE for Open Access Subscribers

SubscribeSummary

It is no longer headline news that private accommodations are an integral part of the travel landscape. Airbnb, the sharing economy pioneer, has been around for nearly a decade, and scores of other home-sharing websites around the world are changing the way consumers think about where to stay. Now that renting is mainstream, all travel brands must understand the droves of travelers powering the rising home rental market. American and European renters stand out not only among themselves, but from the broader traveler population as well. Travel marketers in particular must pay close attention to the rise of rentals, as more and more of these coveted frequent travelers opt for a home over a hotel.Analysts

Free For Subscribers

What is Open Access

An Open Access subscription provides company-wide access to the whole library of Phocuswright’s travel research and data visualization.

Learn MoreCurious? Contact our team to learn more:

+1 860 350-4084 501 sales@phocuswright.comWhat is Open Access+

With Open Access+, your company gets access to Phocuswright's full travel research library and data visualization PLUS Special Project deliverables.

Learn MoreCurious? Contact our team to learn more:

+1 860 350-4084 501 sales@phocuswright.comProvide your information and we'll contact you:

What is Open Access

An Open Access subscription provides company-wide access to the whole library of Phocuswright’s travel research and data visualization.