Airbnb Accommodates Broad Spectrum of Travel Spenders

- Published:

- April 2016

- Analyst:

- Brandie Wright

For some types of businesses, offering consumers choice is a big deal. Hotels offer a perfect example: Because big hotel chains often manage a variety of different brands, they can suggest options from budget properties and posh, boutique hotels to lavish, upscale resorts, hoping to appeal to the broadest range of consumers possible. But, perhaps unintentionally, Airbnb might be winning at the differentiation game.

The rising popularity of Airbnb is not a new story. More travelers are renting. But now that the sharing economy is in full swing, more consumers are now comfortable hosting. Airbnb's supply seems to be growing exponentially, offering renters an unprecedented range of accommodation choices. Options can range from a US$15 per night spot on the couch to an $8,000 per night mansion on a sprawling 100-acre property (and everything in between). Airbnb offers something for everyone, and the website is attracting a wide range of spenders.

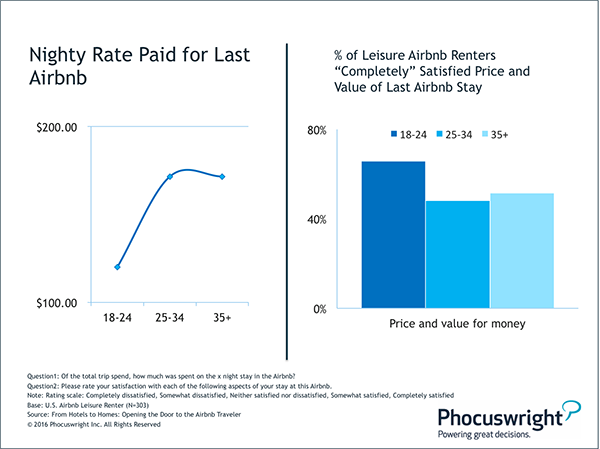

For example, while younger consumers typically have a passion for seeing the world, they often travel on a tight budget. Tastes and preferences, however, generally become a bit more expensive a few years down the road, once travelers get a bit older and settled into their careers. These general patterns in leisure travel spending are becoming increasingly apparent among Airbnb renters. According to Phocuswright's From Hotels to Homes: Opening the Door to the Airbnb Traveler, leisure Airbnb renters between the ages of 18 and 24 paid roughly $100 per night for their last Airbnb (see Figure 1). Nightly rates, however, spike among older age groups, generally closer to $200.

Figure 1

(Click image to view a larger version.)

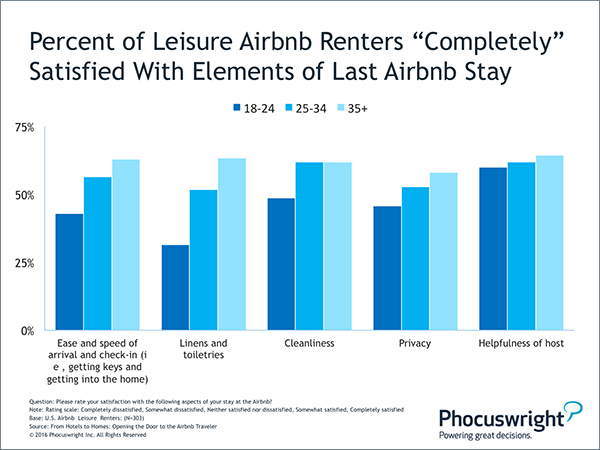

Younger Airbnb'ers truly appreciate the low-cost lodging options made available by the private accommodation brand. Compared to older groups, younger renters were significantly more likely to be "completely" satisfied with the price paid and value of their last leisure Airbnb stay (see Figure 1). Low prices are important to them because it simply makes travel possible. Older renters, however, may not have been as satisfied or concerned with price because other elements of the travel experience become more important with age – such as splurging on nicer listings with better amenities and more comfort. When asked to rate different elements of their last Airbnb stay, older travelers expressed a significantly higher level of satisfaction with the arrival and check-in process, linens and toiletries, cleanliness and privacy (see Figure 2).

Figure 2

(Click image to view a larger version.)

Most of the big hotel chains realize that offering a single type of lodging experience to a globe of travelers with a wide variety of tastes and preferences is a surefire way to limit profits. Because Airbnb still draws a younger audience, most hotel groups consider their lower cost brands to be most at risk to direct competition. Study findings suggest, however, that plenty of Airbnb'ers are booking upmarket, offering another piece of evidence that Airbnb's competitive threat to hotels is stronger than most think.

Phocuswright's From Hotels to Homes: Opening the Door to the Airbnb Traveler offers an unprecedented view of the Airbnb consumer – exploring who's renting with the brand, why and how often. This study also takes a deep dive into travelers' last Airbnb rental experiences, revealing facets about their trips such as what motivated them to rent, where they stayed and for how long, their experiences with hosts, overall satisfaction and much more. This report also delves into the business side of things, examining the experiences of travelers who rented an Airbnb for a business trip within the past two years.

Learn more and purchase your copy HERE.