RESEARCH ROUND-UP

A highlight of research insights from 2022

WEEKLY RESEARCH INSIGHTS

We dig deep to give you the data and trends that drive the travel, tourism and hospitality industry.

Get the latest in travel industry highlights with our free weekly research articles and more. Sign up to get the latest delivered directly to your inbox.

2022, thus far

Here's a look at the most important research and data Phocuswright has published so far in 2022.

the 7 biggest tech trends influencing travel in 2022

Each year, Phocuswright’s expert analysts identify the technology and innovation trends that will influence travel significantly in the years to come.

Read more: Travel Innovation and Technology Trends 2022

- A dramatic acceleration in digital change has taken hold: From touchless journeys and robotic automation to the rise of remote working.

- The landscape is a-changin': We witnessed the turn in fortunes of SPACs and the entry of tokenization and NFTs into common parlance.

- 2022 is a year of continued business model experimentation: Fintech is all the rage.

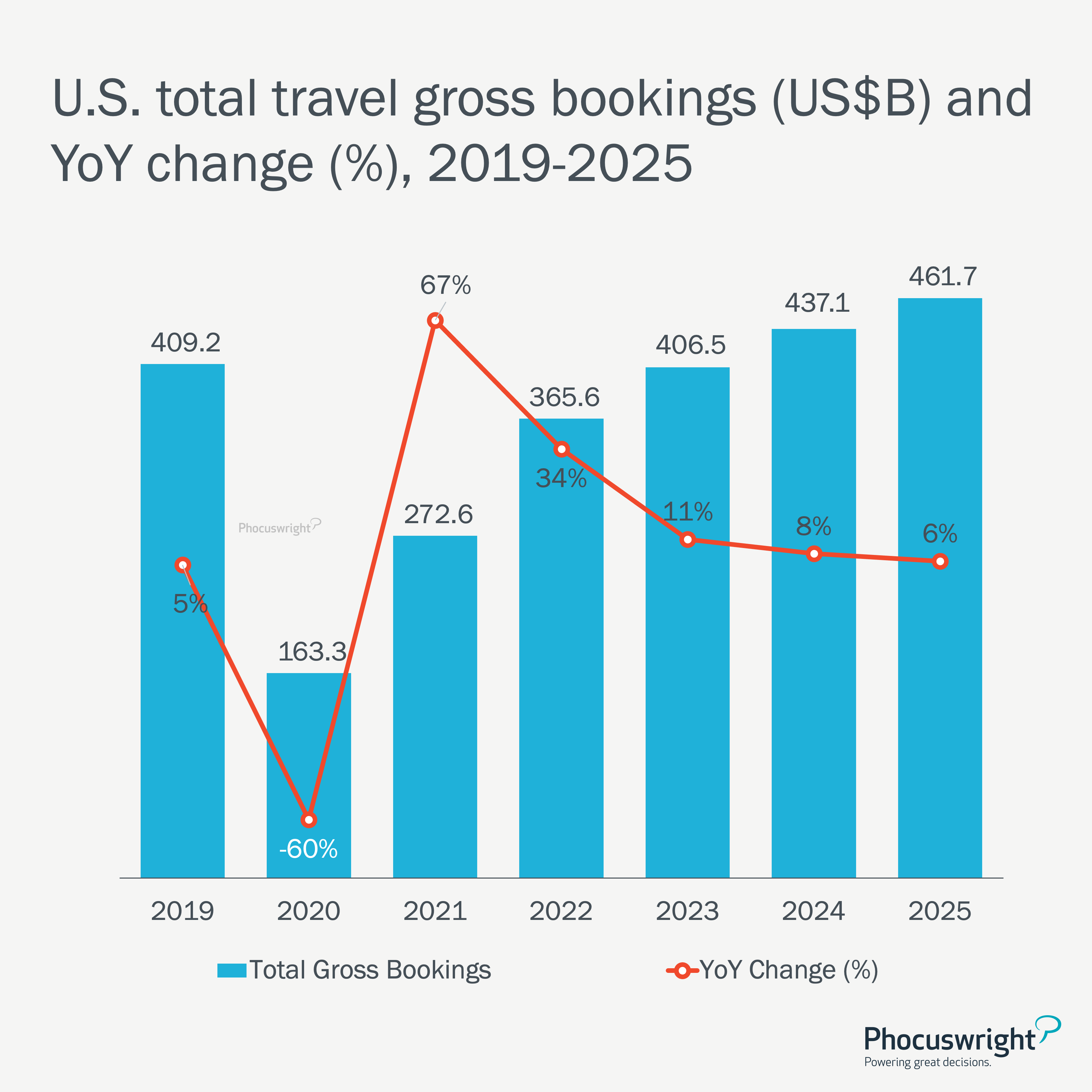

The U.S. travel market REACHEs two thirds of its 2019 size

Read more: U.S. Travel Market Update 2021-2025

- A firm rebound for all but one segment: The U.S. travel market grew 67% to $272.6B in 2021. All segments, except cruise, rebounded firmly; the packaged travel market recorded the highest growth rate at 251%.

- Online on the up and up: Online sales performed much better than the total travel market in 2021, rising 86% to $177.2 billion.

- Don't call it a comeback - yet: The U.S. travel industry is expected to nearly reach its pre-pandemic size by 2023, and continue making modest gains in subsequent years.

Hotel and lodging represents 51% of all U.S. travel gross bookings

Read more: U.S. Hotel & Lodging Market Report 2021-2025

- Hotel bookings bounced back to 85% of pre-pandemic levels in 2021: And a fuller recovery is on the horizon as business and group travel gain steam.

- Hotels comprised an unusually large share of U.S. travel bookings in 2021: With air bookings recovering more slowly, hotels were responsible for more than half of all travel dollars spent. But as air sales rise, hotels will not keep this share for long.

By 2023, hotel supplier-direct will again surpass otas

Read more: U.S. Hotel & Lodging Market Report 2021-2025

- The booking battle: OTAs were the largest channel for online hotel bookings in 2021, but the supplier-direct channel will overtake them by 2023.

- Marketing and loyalty campaigns from hotel suppliers played a prominent role in recapturing share: The supplier-direct online channel capitalized on hotels' "book direct" campaigns, loyalty members' increasing app use for convenience and deals, as well as traveler preference for direct contact with hotels.

- U.S. hotel OTA gross bookings approached $41B in 2021: Bookings are nearly at 2019 levels after rising 97% YoY from 2020.

Myth-busting the new digital nomad

Read more: The New Nomads: Work and Play From Anywhere

- The new digital nomads have more spending power than you think: Digital nomadism can rack up a bill. As a group, nomads are more educated and have higher household income than the general traveling population.

- Freelancers aren't the only types of workers joining the party: While self-employed and freelancing workers led the trend in the past, new work conditions have pulled the fully-employed folks into the remote work craze.

- Think senior employees and upscale accommodations: Many of those adopting the lifestyle are in mid to upper management, and their lodging preferences skew towards luxury.

Over half of most recent short-term rental stays were booked through airbnb

Read more: Through the Roof: U.S. Short-Term Rentals 2021

- Airbnb dominates in rental platform recognition and usage: More than half of short-term rental users booked their most recent rental through Airbnb.

- The pandemic gave brand power more cache: 2 out of 3 travelers say the pandemic has made it more important for them to use brands they know and trust.

- Travelers often associate more familiar brands with better performance: It's common for travelers to assume market leaders are strong across all measures of performance. Strategic messaging can reinforce those beliefs or open their minds to other platforms.

TOP drivers of conversion for short-term renters

Read more: Through the Roof: U.S. Short-Term Rentals

- Location is king: STR users are most likely to report good location as the factor that makes them hit the book button.

- Rental users evaluate properties holistically: While some aspects of a property get more attention than others, it takes a suite of good features to drive conversion.

- But who says looks don’t matter?: The majority of rental users say they actively seek out properties with an interesting look and feel.

5 things to know about European attitudes on sustainability

Read more: Sustainability in European Travel

Here are 5 things to know about European attitudes on sustainability:

- Sustainability is a consideration when Europeans book travel: Travelers care about their choices' impact on the planet.

- But Europeans travelers aren't ready to put their money where their mouth is: Only a third are willing to pay to offset their carbon footprint and less than a fifth will spend more on fares with airlines that use sustainable fuels.

- All aboard now: One third or more travelers in Spain, Italy, France and the U.K. intend to use rail more frequently in future trips.

Travel startups skew towards lodging verticals

Read more: The State of Travel Startups 2021

- Hotel, hostel and short-term rental startups are rising in prominence: Collectively, they represent 30% of travel startups founded since 2010 and have received more than $12B in funding.

- Short-term rental startups are accelerating: Highlighting the consumer opportunities and technologies still needed in the vertical.

- Air and tours & activities close out the top categories: Each representing 10% share of travel startups.

To explore the data behind the analysis, please check out The State of Travel Startups Interactive Database, available for Open Access subscribers.

FUNDING to business travel startups explodes despite pandemic blows

Read more: The State of Travel Startups 2021

- Reinventing booking and service: Despite the dip in business travel and the rise of remote work, startups catering to this segment are attracting big funding by reinventing the way corporate travel is booked and serviced.

- Top funded travel startups in corporate vertical: TripActions, TravelPerk and Divvy, all founded since 2015, have raised almost $2.4 billion between them.

To explore the data behind the analysis, please check out The State of Travel Startups Interactive Database, available for Open Access subscribers.

These regions lead in innovation and startups

Read more: The State of Travel Startups 2021

Here’s where travel startups are being founded and a breakdown of where innovation is thriving by region:

- U.S. and China are home to the largest number of travel startups: The U.S. accounts for 92% of startups in North America and nearly 3x the number of startups as China.

- Europe is at the heels of North America: The continent has been an attractive base for startups founded since 2016.

- Three in 5 APAC startups are headquartered in China or India.

10 things you might not know about the travel startup landscape in 1 minute

Read more: The State of Travel Startups 2021

Funding trends have changed, acquisition periods have shifted. There's a lot to understand about where travel startups are thriving and the horizontals that are finding the most success.

Here are 10 things you may not know about the state of the travel startup landscape in 2022:

FOR MORE INSIGHTS

See all of Phocuswright's free research insights here.

Sign up to get the latest delivered directly to your inbox.

Open Access Research Subscription

Research is our priority. Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips.

Clients have relied on Phocuswright's deep industry knowledge for over 25 years to power great decisions, help justify a pitch, build a strategic plan and elevate any presentation through trusted research and data. When companies and executives reference Phocuswright, they gain the trust of an industry keen on data, trends and analytics.

See the full benefits of an Open Access subscription here.