Hotels win small victory: So why are we still arguing about OTAs?

- Published:

- February 2018

- Analyst:

- Lorraine Sileo

Hotel loyalty rates are making a dent, but is it enough to make hotels happy?

Hotels have long lamented their dependence on online travel agencies (OTAs) and their ascribed high cost of distribution (commission or mark-up). Over the years, Hilton, IHG and Hyatt are among the brands that have tried to cut the cord (generating dramatic headlines), only to rejoin the OTAs with fresh, new agreements. While it's easy to say that hotels are fighting a losing battle – since OTAs now make up more than one fifth of U.S. hotels' overall revenue – the fact is that chains are making some inroads. Perhaps hotel loyalty rates – whereby loyalty members get unique discounts for booking direct – are paying off after all.

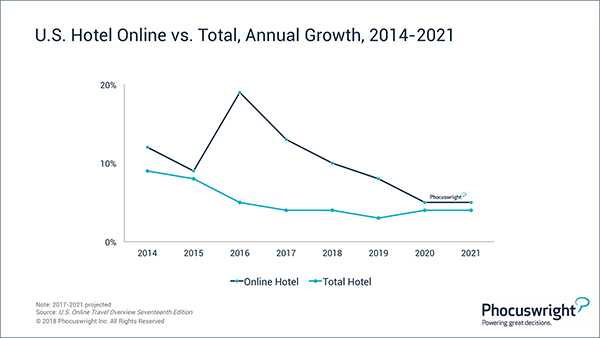

The truth is that OTA hotel sales keep growing because U.S. hotel sales are rising modestly while the shift from offline to online is accelerating at nearly three times the pace. U.S. hotel sales gained 4% in 2017 to reach US$158 billion, but the online hotel segment (including both OTAs and hotel websites/apps) jumped 13% to $69.3 billion. These gains are based on the simple fact that offline processes, such as calling the hotel or using a travel agency, will continue to give way to desktop/laptop and mobile devices for young and old. Still, 56% of hotel sales are offline, including corporate, groups and traditional channels.

(Click image to view a larger version.)

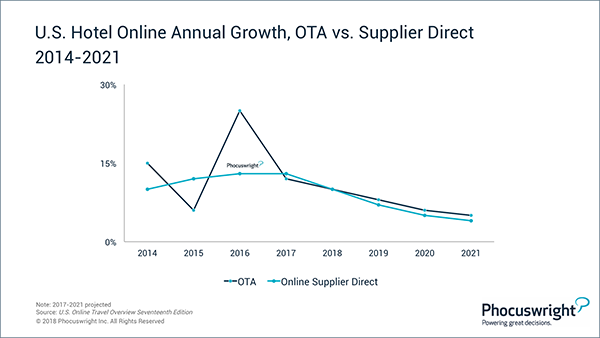

The phenomenal online growth for hotels is not just credited to the fortitude of Expedia and Priceline/Booking.com (annual gains are not expected to recede to single digits until 2019). Considering both channel shift and organic growth, OTAs and hotel websites have both soared over the past 18 years. Most recently, each channel is basically growing in lockstep with the other, meaning that overall, they each represent about half of online hotel sales. This balancing act will continue, regardless of hotel loyalty rates or guest services/features – such as virtual check-in, digital keys and free Wi-Fi – that are reserved only for loyalty members who book direct. OTAs have their own loyalty programs that are gaining ground, and Expedia plans to provide unique guest services as well. The stalemate between hotels and OTAs will be an ongoing scenario, despite the $5+ billion sales and marketing budget of Expedia, not to mention continued gains in the U.S. by Booking.com.

(Click image to view a larger version.)

This doesn't mean hotel loyalty rates are a failure. If anything, hotels would still be losing share considering that most travelers – especially millennials – prefer the choice offered by OTAs1. Hotel chains have shored up their position, especially with older, more loyal travelers. In addition, millions of new travelers, many in the 18-34-year-old age group, have joined programs for the low-hanging fruit (free Wi-Fi and lower prices).

To be sure, there is plenty of work to do for hotels to measure the impact of two-plus years of loyalty rates on the bottom line. If travelers are simply taking advantage of them to save on single bookings, they are not exactly loyal customers. Regardless, the fact that hotels are holding their own vs. OTAs should make many owners and operators happy, but with hotels vying for a perfect world without intermediaries, the question is: Will they ever be happy?

Gain a comprehensive view of the hotel and lodging market in the U.S. – including market sizing and forecasts, loyalty programs, private accommodations and an update on mobile bookings – with Phocuswright's U.S. Hotel & Lodging: Loyalty Rates Make Impact.

Other U.S. Online Travel Overview Seventeenth Edition reports available:

Coming soon:

- Airlines

- Packages & Cruise

- Full Report (including 5 segment reports)

1 Phocuswright's U.S. Consumer Travel Report Ninth Edition, 2017