4 things to know about the future of the U.S. OTA market

From Phocuswright's U.S. Online Travel Agency Market Report 2022-2026

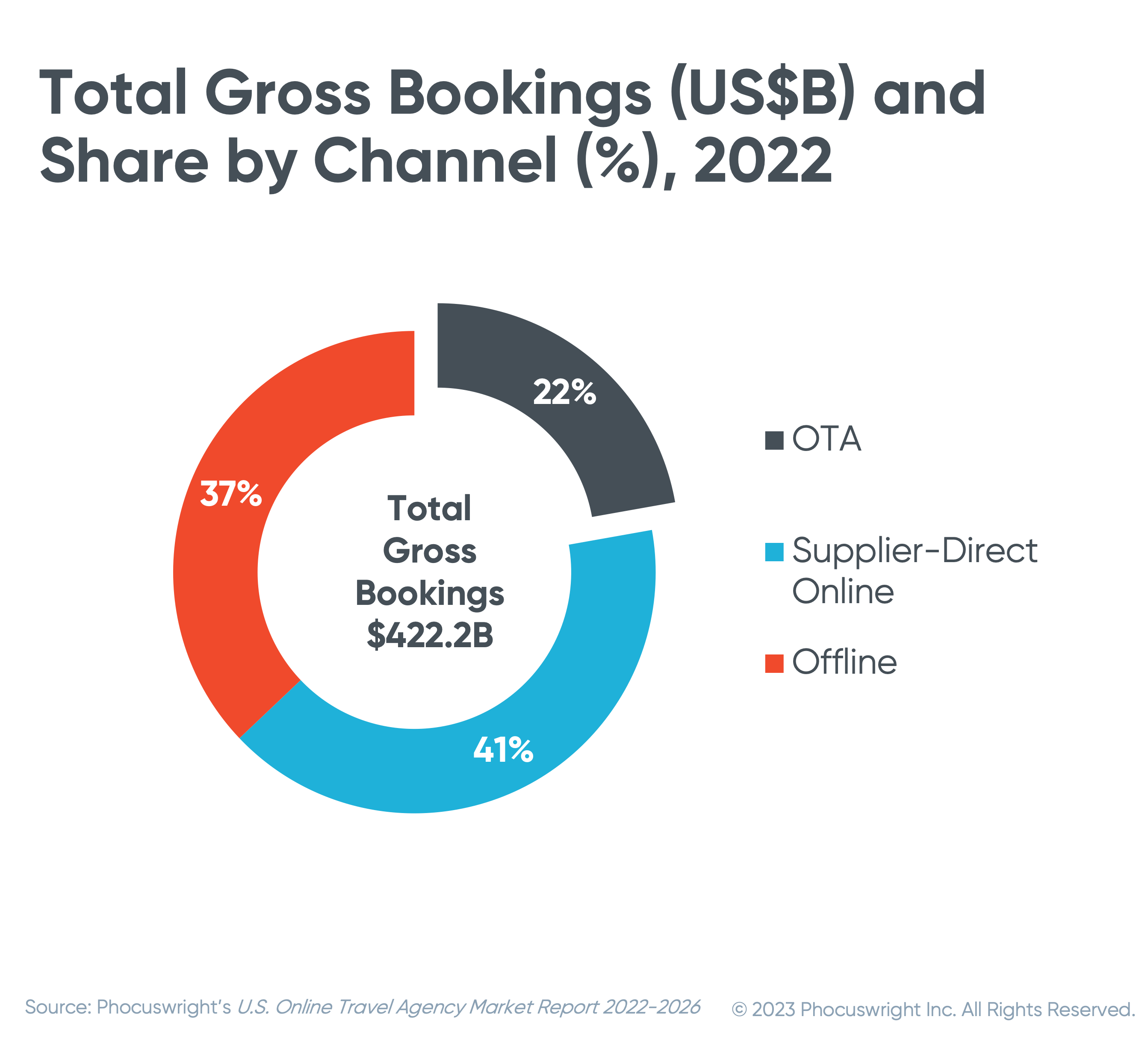

The U.S. travel market continued its stellar recovery in 2022, with total gross bookings of $422.2 billion, an increase of 51% over the prior year. According to Phocuswright's research report U.S. Online Travel Agency Market Report 2022-2026, online and offline travel both showed robust growth, but the channel share shifts seen during the pandemic are slowly changing course. Online channel share, which grew to 65% in 2021, moderated slightly to 63% in 2022 (see figure below) as offline channels showed signs of recovery. Online travel agencies (OTAs) comprised just over a fifth of the total U.S. market while the online supplier-direct channel accounted for 41% of the market.

Phocuswright's U.S. Online Travel Agency Market Report 2022-2026 provides a comprehensive view of the U.S. online travel agency channel, including detailed market sizing and projections through 2026, distribution trends, key developments and more.

Looking ahead

With overall market stabilization anticipated over the next few years, growth will moderate, but remain positive through the rest of the forecast period.

Looking ahead, here are 4 key areas of focus from the research:

Loyalty and Retention: Varied Approaches, Same Goal

With most travelers only taking a few trips a year and price being a primary driver of what and where they book, engaging travelers and keeping them loyal is a tough task. OTAs are making a significant effort on this front, though their approaches vary. Loyalty as a battleground will remain contested in the next few years.

A Renewed Focus on Apps

While OTAs like Hopper and HotelTonight have always been app-first or app-only, mobile was just one part of the puzzle for the larger OTAs. But several factors, among them reducing their marketing spend and their reliance on Google, along with their need to acquire first-party data, have made direct customer interaction via their own sites and apps increasingly important.

Phocuswright's research has consistently shown that consumers visit multiple sites when shopping for travel in a bid to save a few dollars. Will discounts or rewards turn them into loyal, returning customers? Are apps the channel to induce that behavior? Loyalty and apps, together, will remain a closely watched area over the coming years.

B2B Gains Traction

Even as the consumer side of the business went from strength to strength, the OTAs have been steadily increasing their B2B portfolios, as supply partners, powering various service offerings or through white-label platforms. Historically it was travel suppliers who partnered with the OTAs in a bid to supplement their core products. But more non-travel brands, especially financial institutions, are now partnering with the OTAs to sell travel. The goal, as outlined in Phocuswright's recent article, is not to gain substantial revenue but to keep their customers coming back and encourage card usage (more points to redeem). For the OTAs, these partnerships can be quite profitable.

Short-term Rentals

Though Airbnb continues to dominate the conversation, STRs remain a significant part of the business for both large OTAs. Booking.com grew its STR room-nights by 56% in 2022 and they now account for 30% of total room nights. It also introduced new policies and services for property owners or managers including a damage policy, liability insurance and request-to-book functionality. The importance of STRs to Booking.com is underscored by its Superbowl LVII ad featuring Melissa McCarthy. Meanshile, Expedia is migrating Vrbo onto the same platform as its other major brands in 2023. It expects the new OneKey loyalty program, which will give short-term renters the benefit of a loyalty program, will also drive growth in the future.

This report is part of the U.S. Travel Market Report 2022-2026 series, which features an overview of the U.S. travel market, along with detailed data and analysis of five key segments: airline, hotel & lodging, car rental, cruise and packaged travel. This standalone report dedicated to online travel agencies rounds out the coverage. Collectively, the series provides comprehensive market sizing, projections and analysis for the U.S. travel industry from 2019-2026.

Other reports in the U.S. Travel Market Report 2022-2026 series include:

WEEKLY RESEARCH INSIGHTS

We dig deep to give you the data and trends that drive the travel, tourism and hospitality industry.

Get the latest in travel industry highlights with our free weekly research articles and more. Sign up to get the latest delivered directly to your inbox.

FOR MORE INSIGHTS

See all of Phocuswright's free research insights here.

Sign up to get the latest delivered directly to your inbox.

Open Access Research Subscription

Research is our priority. Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips.

Clients have relied on Phocuswright's deep industry knowledge for over 25 years to power great decisions, help justify a pitch, build a strategic plan and elevate any presentation through trusted research and data. When companies and executives reference Phocuswright, they gain the trust of an industry keen on data, trends and analytics.

See the full benefits of an Open Access subscription here.