Trusted Analysis, Unbiased Research

Tap into Phocuswright’s unparalleled library of independent data, research and analysis. Our research products, subscriptions and services inspire smart strategic planning and growth. See all of our travel research reportsDistribution & Marketing

OTAs / Metasearch Travel Agents / Tour Operators GDSs / TMCs Tech / AdvertisingWe Are Global

Also check out our upcoming research and explore how to engage with us.

Ways to Engage

An Open Access research subscription provides company-wide access to the world's most comprehensive library of travel research and data visualization.

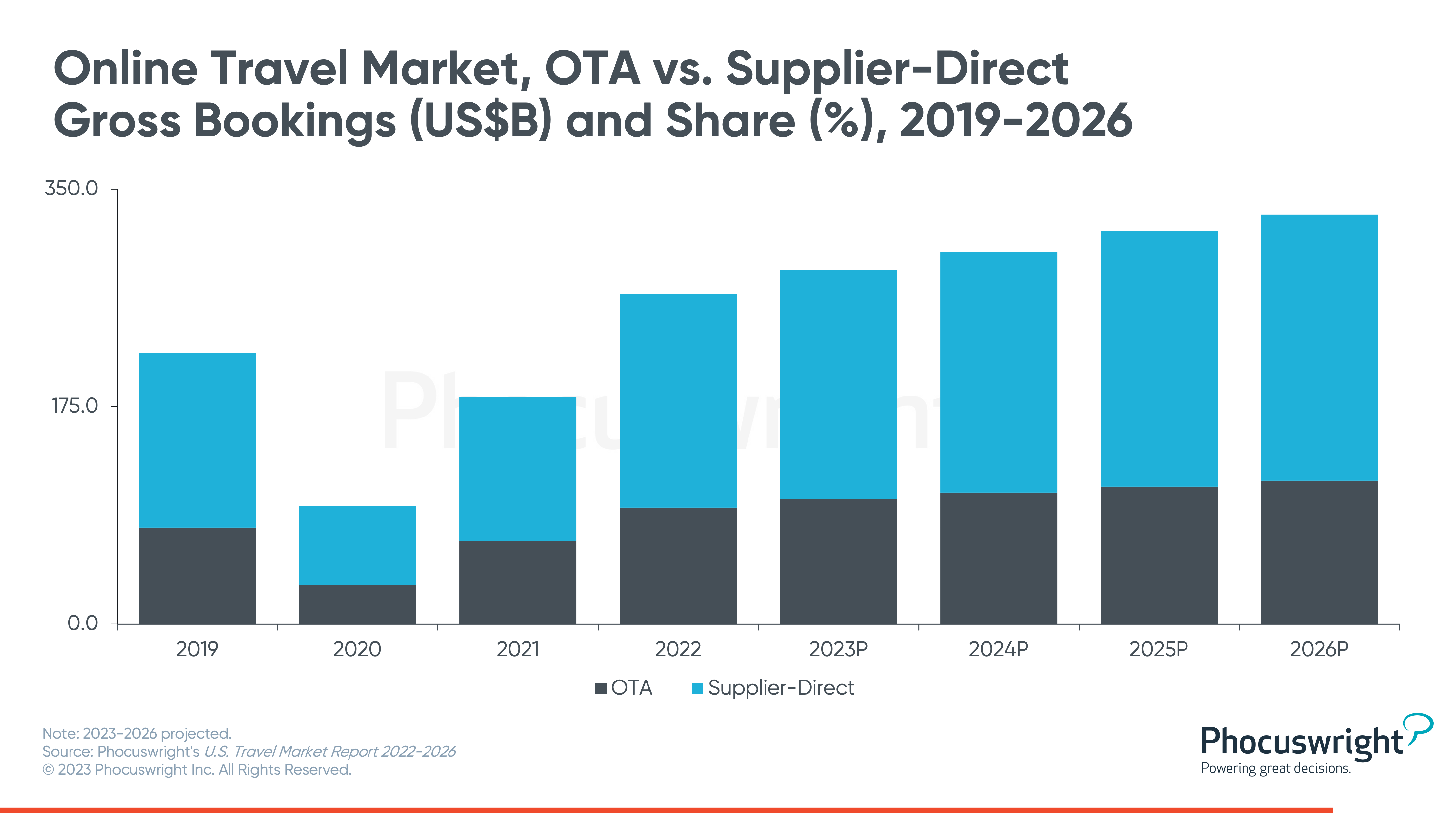

Market Sizing Data on Different Segments

Covering 30+ countries

Condensed Reports for Easy Overviews

Consumer Research

Weekly Research Insights and More

Sign up today to stay up-to-date:

- Weekly research insights articles

- Event updates

- Recently published research list

- And more!

Explore Phocuswright's Products and Services

Phocuswright offers so many ways for your company to gain competitive advantage with our independent research and analysis. From a free download to purchasing an individual report to a company-wide all-access subscription, there's something for every budget. You can also sponsor upcoming research or customize your own!

Learn More

Phocuswright events are industry favorites shining the spotlight on travel innovation, networking and great content.

Learn More

With an arsenal of Phocuswright's deep, research-driven assets at its disposal, PhocusWire provides daily exposure to sought-after research, valuable industry data and expert analysis.

Learn More

Whether you're in need of research about travel technology or the startup scene, a startup looking to make connections, or an investor seeking new companies to work with, we can help.

.png)