OTA bookings projected to climb 55% in Europe

- Published:

- July 2021

- Analyst:

- Phocuswright Research

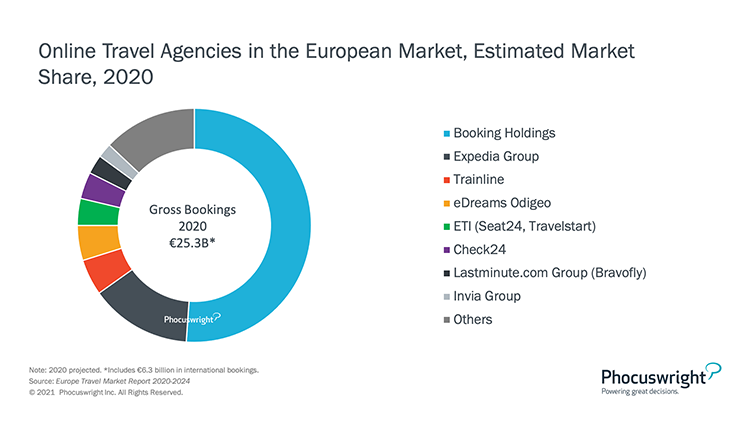

Despite the challenges presented by the online direct channel, OTAs remain vital to the European travel distribution landscape, especially in the highly fragmented hotel & lodging segment. According to Phocuswright's latest travel research report Europe Travel Market Report 2020-2024, in 2020, OTAs captured roughly 64% of online hotel & lodging bookings, in a segment characterized by an abundance of smaller, non-chain properties that do not focus on driving direct online bookings. In other segments, OTAs have struggled to grow online market share, though for different reasons. In the rail category, the presence of a single national carrier in many markets has prevented OTAs from gaining a significant foothold (though rail specialist Trainline has been quite successful in the U.K. market, where there are multiple train operators). In the tour operator segment, the relative complexity of the product gives suppliers a distinct advantage, though prepackaged holidays represent a clear opportunity for OTAs.

(Click image to view a larger version.)

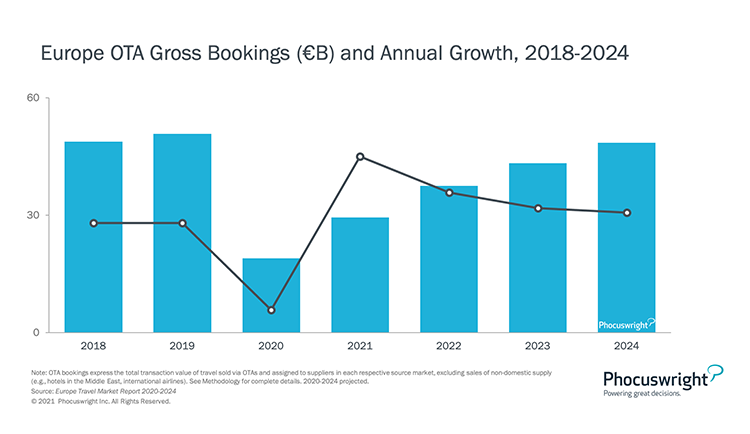

With widespread hotel closures and scant air travel available, OTA product supply was severely limited in 2020. As the vaccination rates in Europe improve - and infection rates drop - demand for leisure travel will escalate quickly, and OTAs are primed for a strong recovery. Given OTAs' strong focus on flights and accommodation, recovery is closely tied to the performance of those segments. In 2021, OTA bookings are projected to climb 55%, with more modest (yet still double-digit) gains in subsequent years.

(Click image to view a larger version.)

To compete effectively with key suppliers across segments, OTAs will rely more heavily on their mobile apps as a source of growth. There is wide variation in the investments that OTAs have made in their mobile platforms, and in the impact that these commitments to mobile have made.

This report provides comprehensive market sizing and projections for the European travel industry from 2018-2024, including analysis of key segments, country-level share and trends, distribution dynamics and more.

Also in this series:

- Europe Travel Market Data Sheet 2020-2024

- France Travel Market Report 2020-2024

- Germany Travel Market Report 2020-2024

- Italy Travel Market Report 2020-2024

- Scandinavia Travel Market Report 2020-2024

- Spain Travel Market Report 2020-2024

- U.K. Travel Market Report 2020-2024

Did you know that you and your entire company can access this report with an Open Access subscription? That's just one of the key benefits, along with access to our data visualization tool Phocal Point, service from our excellent Customer Concierge team and more. See the benefits of subscribing here.

.png)

.jpg)