The End of Alternative Accommodation: Airbnb is Now the Third-Largest Online Accommodation Seller Worldwide

- Published:

- August 2016

- Analyst:

- Douglas Quinby

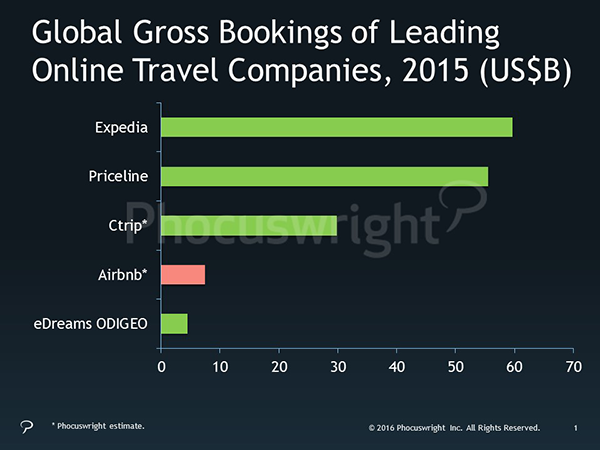

Earlier this week, online travel industry news broke that Airbnb filed paperwork for its latest round of funding at a valuation of US$30 billion. Reports on the private accommodation site's business performance have also trickled out, along with a flurry of notes from financial analysts with varying estimates for bookings and future growth. We at Phocuswright have reviewed all of these reports and built our own estimates for Airbnb and the global private accommodation market. One striking finding is coming into focus: Airbnb is now the third-largest online seller of accommodation worldwide, and it is probably the fourth-largest online travel intermediary by gross bookings.

Several estimates put Airbnb's 2015 gross bookings at approximately $7.5 billion (some are as high as $9 billion, while the low end of one model is a little more than $6 billion). Even at the lower end of that range, Airbnb's gross bookings for 2015 could be close to or slightly above accommodation bookings for China's Ctrip[1] and Japan's Rakuten[2]. Given the rental site's rapid growth (faster still than Ctrip), Airbnb would certainly surpass both in 2016. These booking volumes, even at the lowest end of the range, also put Airbnb well ahead of all regional online accommodation sellers, including Germany's HRS, the U.K.'s Travel Republic, and Ireland's Hostelworld Group, among others.

The online travel company is also likely to be nipping at the heels of Expedia in Europe in terms of accommodation gross bookings. Airbnb has stated that Europe represents about half of its business. If the company keeps its growth pace and Europe maintains its share of the site's bookings, Airbnb could surpass Expedia's accommodation business in Europe as soon as 2017.

One key factor for Expedia will be HomeAway's online booking migration, which appears to be going well. The online vacation rental leader has estimated some $12-15 billion in gross bookings are enabled through its marketplace. But most of those bookings were still taking place offline in 2015. If HomeAway can continue to execute its online strategy in Europe, which is a big part of its rental business, that may keep Expedia's European accommodation bookings ahead of Airbnb's.

The Fourth-Largest OTA?

Accommodation aside, Airbnb is likely to be the fourth-largest online travel intermediary overall by year-end 2016, probably surpassing Europe's eDreams ODIGEO in total gross bookings. (The latter focuses on flights and lets the Priceline Group's Booking.com power its hotel path.) The figure below presents total gross bookings for the world's largest online travel agencies and a mid-range estimate for Airbnb.

(Click the graphic to view a larger version.)

While Airbnb's gross bookings (even using the most aggressive forecasts for 2016) will still be well below the top three OTAs, the company's private market valuation of $30 billion makes Airbnb the second most valuable online travel company. The private accommodation site is currently more valuable than Expedia, TripAdvisor and Ctrip, and nearly half as valuable as Priceline. It is often said that comparisons between public and private market valuations are hardly fair. Still, the expectations for Airbnb's future growth and profitability are enormous.

What This Means for the Global Travel Industry

For several years, Phocuswright has been covering the rise of Airbnb and private accommodation, and the implications for the travel markets in the U.S. and Europe. But here are two themes that stand out:

What duopoly? Complaints have continued far and wide across our industry as the two online giants – Expedia and Priceline – amassed a majority of the global online travel agency market (nearly two thirds of global OTA gross bookings in 2015). Hotels sounded off with regulators about too much market power in the hands of too few; marketers and entrepreneurs across the industry bemoaned their inability to compete against the ad-spend muscle of the big two. And yet, three guys without a lick of travel industry experience got together and have managed to create the fourth-largest online travel intermediary, just as OTA consolidation accelerated. So who says you can't build an online travel company today?

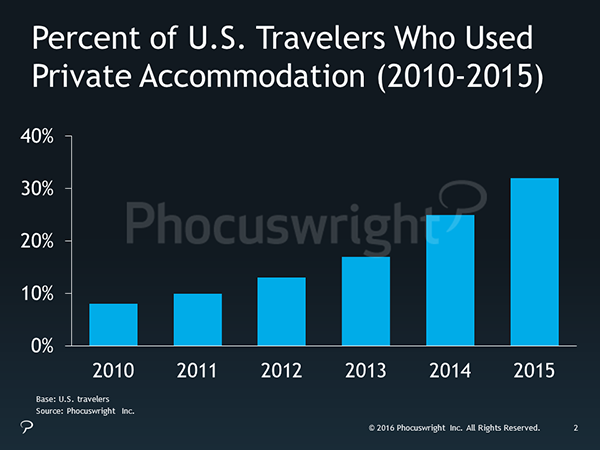

The end of alternative accommodation. Airbnb's ascent, Expedia's HomeAway acquisition, and the continued investment and growth in rentals by Booking.com, TripAdvisor and others signal the arrival of a trend Phocuswright has been speaking to since 2008: the mainstreaming of private accommodation. Nearly one in three U.S. travelers stayed in some form of private accommodation in 2015, up from about one in 10 in 2011.

(Click the graphic to view a larger version.)

Simply put, renting a home or apartment is no longer an "alternative" or a "non-hotel" accommodation. It is now commonly considered in the lodging decision. And while it leans heavily leisure, we are seeing increasing use among business travelers as well. More than three in 10 U.S. travelers who have used Airbnb have used it for business travel, and rentals will have a growing impact on both the corporate and groups and meetings markets.

Learn more about the rise of Airbnb and private accommodation from two key Phocuswright travel research reports:

- From Hotels to Homes: Opening the Door to the Airbnb Traveler

- Rentals Rising: The State of Private Accommodation in U.S. Travel

Hear Chip Conley, Airbnb's head of global hospitality and strategy, speak at The Phocuswright Conference in November. View program, speakers and register HERE.

[1]This does not include accommodations that are part of packaged tours booked on Ctrip.

[2] Ctrip and Rakuten accommodation gross bookings are Phocuswright estimates.

.png)

.jpg)