There's More to Travel's Online Rentals Story Than Airbnb

- Published:

- November 2016

- Analyst:

- Douglas Quinby

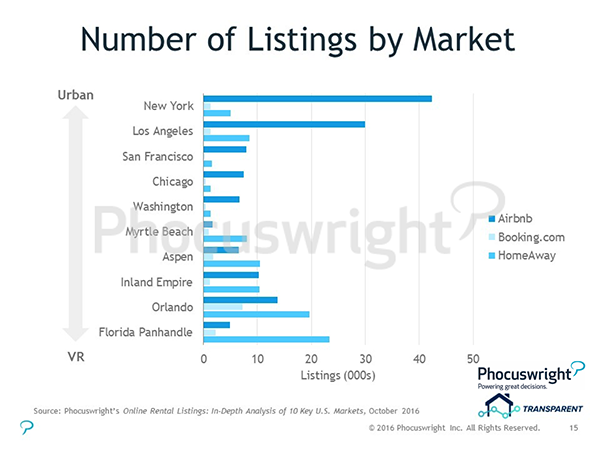

Airbnb may capture most of the media attention around home rentals for travel, but it is by no means the only story in the rapidly growing private accommodation marketplace. Phocuswright's Online Rental Listings: An In-Depth Analysis of 10 Key U.S. Markets for Airbnb, Booking.com and HomeAway, a new study conducted in partnership with rental analytics firm Transparent, found that while Airbnb leads by a substantial margin across the five largest urban markets in the U.S., HomeAway has a much stronger foothold in the five leading vacation rental markets.

Click the image to view a larger version.

Airbnb Has Been Gaining Ground on HomeAway's Home Turf

In urban destinations, Airbnb has more than five times as many listings as HomeAway. By comparison, the HomeAway's lead in vacation rental markets is not as wide. Across the five vacation rental markets covered in this report, the number of listings on HomeAway is almost twice that of Airbnb. Airbnb has made significant headway in traditional vacation rental markets. According to Phocuswright's report on the U.S. private accommodation market, A Market Transformed: Private Accommodation in the U.S., 2016, 47% of vacation rental property managers report using Airbnb in 2016 versus just 7% in 2012.

Online Rental Listings: An In-Depth Analysis of 10 Key U.S. Markets for Airbnb, Booking.com and HomeAway presents analysis of nearly 237,927 online rental listings in the five largest urban and vacation rental markets for private accommodation in the U.S. Phocuswright partnered with Transparent, an analytics firm for private accommodation, to gather listings data from three leading online rental marketplaces: Airbnb, HomeAway and Booking.com.

Key topics include:

- Detailed analysis of listing volume, including segmentation by market and rental site for unit types (homes, apartments, etc.) and rental types (whole homes and shared spaces)

- Analysis of single and multi-listing owners and hosts by market for Airbnb and HomeAway

- Pricing trends by market and rental site

- Guest review trends by market and rental site, including review volume and guest scoring

Phocuswright's Online Rental Listings: An In-Depth Analysis of 10 Key U.S. Markets for Airbnb, Booking.com and HomeAway sizes the largest urban and vacation rental markets in the U.S. and assesses the state of urban and vacation rental markets. Purchase today to understand key trends across the leading online rental marketplaces of Airbnb, Booking.com and HomeAway.

.png)

.jpg)